| |

| Author |

Topic Options

|

Sunnyways

Forum Super Elite

Posts:

Posts: 2221

Posted: Posted: Tue Dec 10, 2019 8:32 am

DrCaleb DrCaleb: Sunnyways Sunnyways: What sort of dodgy yob can leave a country ‘within minutes’? Many of them are thieves and worse from Russia and other blighted places. Britain would be better off without them. Most of the oligarchs are citizens of Malta anyway, for tax purposes. Some of the Russkies bought citizenship there. Another problem is that many megawealthy British and Irish citizens are resident-for-tax-purposes in tax havens like Malta, Gibraltar, the Isle of Man, Monaco and the Channel Islands, i.e. they pretend to have moved there but continue to live in Britain. Canada is a bit more advanced than Europe in this regard, having a ‘strength of ties’ set of criteria that examine in detail a person’s claim to have moved to another country, e.g. location of primary residence, spouse, kids’ schools, club memberships, health care insurance etc. The message should be simple - if you want to leave, fine, but we are going to check you have genuinely done so.

|

Posts:

Posts: 4914

Posted: Posted: Tue Dec 10, 2019 8:49 am

DrCaleb DrCaleb: uwish uwish: do you know how many min wage jobs it would take to replace the taxes paid by a millionaire? One. Two, maybe. you are being sarcastic no?

|

Posts:

Posts: 10503

Posted: Posted: Tue Dec 10, 2019 9:00 am

I too have little sympathy for a a pack of rich whiney big wigs crying because they don't like the government the people elected. Maybe the people don't like the government the ultra-rich elect. Boo-fucking-hoo.

|

Sunnyways

Forum Super Elite

Posts:

Posts: 2221

Posted: Posted: Tue Dec 10, 2019 9:17 am

uwish uwish: do you know how many min wage jobs it would take to replace the taxes paid by a millionaire? That depends on how the zillionaire in question has structured his assets. Many wealthy Brits are already largely offshore at tax time. They may still pay a substantial whack by ordinary Joe standards but nowhere near what they would if they were tax-resident in the UK. In that regard, such threats coming from the same accountants who have created these ‘tax-efficient vehicles’ have their funny side.

|

Posts:

Posts: 53169

Posted: Posted: Tue Dec 10, 2019 9:21 am

uwish uwish: DrCaleb DrCaleb: uwish uwish: do you know how many min wage jobs it would take to replace the taxes paid by a millionaire? One. Two, maybe. you are being sarcastic no? A little. But mostly, no. Millionaires have methods of tax avoidance that most people don't. They can re-direct their income to a Hedge fund for example, and automatically pay less on capital gains than the poor do on regular income. Warren Buffet was right in that his secretary paid more in income tax than he did, because he had the advantage of these tax breaks that were written into law by people like him who have the money to buy the politicians. Regan eliminated the inheritance tax that ensured that the wealthy will never have to pay their fair share of income tax, and the poor and middle class will continue to pay the bulk of Government personal income tax. So when Millionaires actually pay 40%+ tax on their income, I'll concede they pay more tax than a minimum wage worker does.  https://www150.statcan.gc.ca/n1/daily-q ... ng-eng.htm https://www150.statcan.gc.ca/n1/daily-q ... ng-eng.htm

|

Posts:

Posts: 4914

Posted: Posted: Tue Dec 10, 2019 9:34 am

I never said Capital Gains I said personal income tax, if you think the 8 exec from say Encana that are moving to Denver don't pay the same rates as you then you are very mistaken. My example is specific to the Canadian tax system and not a US extreme example.

8 execs at ~ $1m / year, they cannot hide that income. Investments are a different ball game and yes they pay >40% of that salary in taxes on their salary.

So I ask you again how many jobs at min wage would it take to replace them? I think you can do basic math...

regardless of how much you hate the rich, they are essential for the economy. I know you work for some much richer than you are, people in the $100k or greater income range pay the VAST majority of personal income taxes collected.

Executives in Canada income is of public record it has to be by law. They get taxed personally on that income (salary). In fact you can calculate the tax they would pay based on their released salary info.

|

Posted: Posted: Tue Dec 10, 2019 9:42 am

DrCaleb DrCaleb: Regan eliminated the inheritance tax that ensured that the wealthy will never have to pay their fair share of income tax,   DrCaleb DrCaleb: So when Millionaires actually pay 40%+ tax on their income, Why would they be that stupid ?

|

Posts:

Posts: 2146

Posted: Posted: Tue Dec 10, 2019 10:54 am

uwish uwish: I never said Capital Gains I said personal income tax, if you think the 8 exec from say Encana that are moving to Denver don't pay the same rates as you then you are very mistaken. My example is specific to the Canadian tax system and not a US extreme example.

8 execs at ~ $1m / year, they cannot hide that income. Investments are a different ball game and yes they pay >40% of that salary in taxes on their salary.

So I ask you again how many jobs at min wage would it take to replace them? I think you can do basic math...

regardless of how much you hate the rich, they are essential for the economy. I know you work for some much richer than you are, people in the $100k or greater income range pay the VAST majority of personal income taxes collected.

Executives in Canada income is of public record it has to be by law. They get taxed personally on that income (salary). In fact you can calculate the tax they would pay based on their released salary info.

|

Sunnyways

Forum Super Elite

Posts:

Posts: 2221

Posted: Posted: Tue Dec 10, 2019 11:02 am

uwish uwish: I never said Capital Gains I said personal income tax, if you think the 8 exec from say Encana that are moving to Denver don't pay the same rates as you then you are very mistaken. My example is specific to the Canadian tax system and not a US extreme example.

8 execs at ~ $1m / year, they cannot hide that income. Investments are a different ball game and yes they pay >40% of that salary in taxes on their salary.

. Employees of that type are not the real rich. Their wealth is trivial by comparison. You know you’re seriousy in the money when your tax rate goes down, WAY down. Back to the UK example which is the topic of this thread. $1: Almost every week the multi-millionaire boss and founder of discount retailer Matalan boards his private jet for a two-hour commute to work - from his home in Monaco to the company's head office in Skelmersdale, Lancashire. Last year John Hargreaves picked up a £451,000 pay packet as chairman of the company. That sum shrivels in comparison with the value of his shareholding in Matalan, which is worth close to £400m. But unlike the workers who pack orders and despatch goods from the firm's Skelmersdale distribution centre, Mr Hargreaves vast wealth enables him to take advantage, perfectly legally, of Britain's extraordinarily generous rules for tax exiles. Framed in the days long before the existence of private jets, the rules on "non-residence" allow businessmen, film stars and musicians to spend half a week, every week, within Britain and yet still qualify as a tax exile. The US authorities are tougher than their British counterparts when it comes to allowing "non-residents" to sidestep tax. An American who wants to live in Monaco and become a tax exile has to relinquish his or her US citizenship, a step few are willing to take. The UK makes no such demands; a British citizen who leaves the UK can become a tax exile while retaining British nationality. https://www.theguardian.com/money/2004/ ... sandmoney1The British system of assessing residency by ‘number of days’ is an absurd anachronism that favours the megarich - no prizes for guessing who keeps it that way - and whenever the word legal has to be qualified by an adjective like perfectly or completely, you can safely assume a scam is afoot.

|

Posts:

Posts: 65472

Posted: Posted: Tue Dec 10, 2019 11:32 am

DrCaleb DrCaleb: Millionaires have methods of tax avoidance that most people don't. Like wire-transferring their accounts to the Caymans and then getting on their private plane and flying there...permanently. The rich are the most mobile segment of society in any country these days and most of them are wise enough to hold two or more passports and citizenships that facilitate their rapid movement from one jurisdiction to another. You cause these people to flee at your national peril because they take with them capital, intellectual property, and personal skill in creating and managing wealth. For instance, most of Venezuela's former wealthy class are now enriching neighboring Colombia.

|

Posts:

Posts: 53169

Posted: Posted: Tue Dec 10, 2019 11:36 am

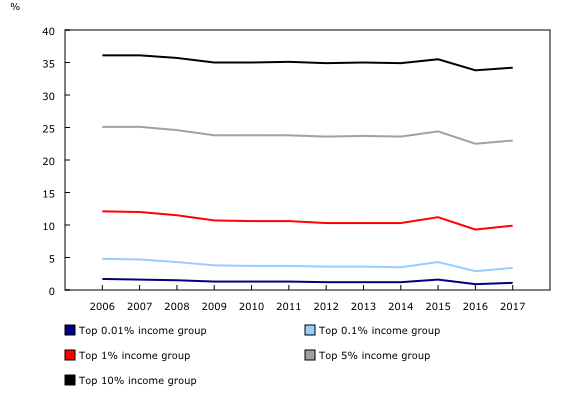

uwish uwish: I never said Capital Gains I said personal income tax, Still not reading what I write, eh? I still wont defend arguments you think I make. That's why I posted that graph from Stats Canada on the income tax paid by various groups. Notice, the top .01% line is just barely even on the graph, and the top 10% line is the top of the graph, with the top 5% under that, and the top 1% under that.

|

Posts:

Posts: 53169

Posted: Posted: Tue Dec 10, 2019 11:37 am

BartSimpson BartSimpson: For instance, most of Venezuela's former wealthy class are now enriching neighboring Colombia. If they weren't contributing their fair share to democracy, they won't be missed anyhow.

|

Posted: Posted: Tue Dec 10, 2019 11:40 am

DrCaleb DrCaleb: BartSimpson BartSimpson: For instance, most of Venezuela's former wealthy class are now enriching neighboring Colombia. If they weren't contributing their fair share to democracy, they won't be missed anyhow.  The problem is that these kinds of locusts are so devastating in their activities that they quite literally leave nothing of value behind them when they migrate to another pasture.

|

Posts:

Posts: 65472

Posted: Posted: Tue Dec 10, 2019 11:42 am

Hmph, point of fact is that Mrs. Bart and myself divested of our real estate holdings in Canada due to rent control issues and due to the increasingly regressive tax structure that discourages foreign investment.

And thanks to President Trump we were able to repatriate over US$1 million and only pay simple income tax. That was a gain to the US and California and a loss to Canada which collected exactly fuck all from those transactions.

|

Posts:

Posts: 4914

Posted: Posted: Tue Dec 10, 2019 11:42 am

DrCaleb DrCaleb: uwish uwish: I never said Capital Gains I said personal income tax, Still not reading what I write, eh? I still wont defend arguments you think I make. That's why I posted that graph from Stats Canada on the income tax paid by various groups. Notice, the top .01% line is just barely even on the graph, and the top 10% line is the top of the graph, with the top 5% under that, and the top 1% under that. still can't do basic math I see... That chart you posted outlines the top income earners in the country. The top 10% and higher...you can clearly see if you goto the table and do some basic addition that the top 10% in the country pay the majority of personal income tax. Thanks for proving my point. and you still have not answered my question, how many min wage jobs would it take in tax revenue to replace a single millionaire?

|

|

Page 2 of 6

|

[ 78 posts ] |

Who is online |

Users browsing this forum: No registered users and 25 guests |

|

|